May 17, 2011 - New research shows that artificial intelligence (AI) Unpredictableonline broker. Whether it's an AI model based on a long short-term memory network (LSTM) or a deep neural network (DNN), theTheir predictions for the stock market have turned out to be dead wrong.

Traditional stock market forecasting methods mainly include fundamental analysis and technical analysis. Fundamental analysis focuses on the company's financial situation and macroeconomic indicators, which is suitable for long-term investment; technical analysis is based on the identification of market behavior patterns, including stock prices, turnover and other indicators, which is more suitable for short-term trading.

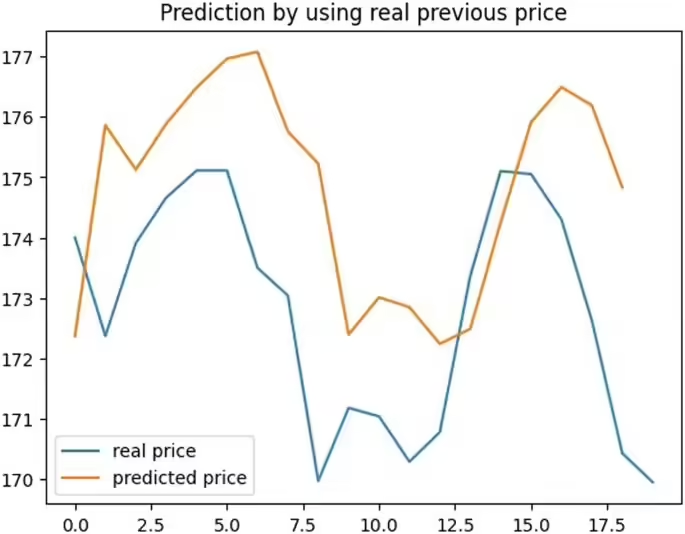

A team of researchers from Sharif University of Technology in Iran used Convolutional Neural Networks (CNN), Long Short-Term Memory Networks (LSTM), Transformer, and a combination of the above models to analyze 12 stocks on the Tehran Stock Exchange (TSE) and compare them to the actual data, and found that the predictions were wildly wrong.

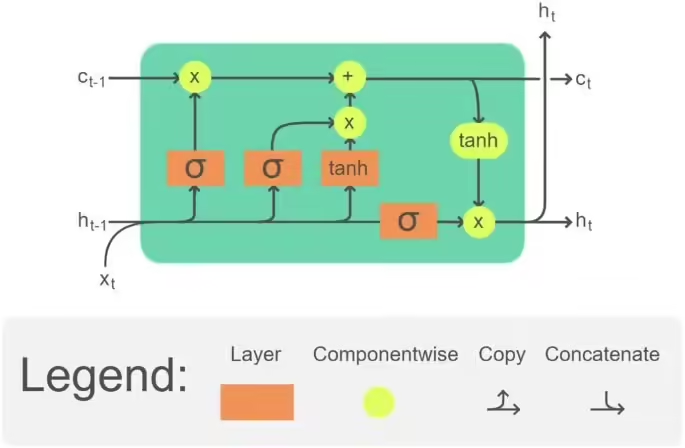

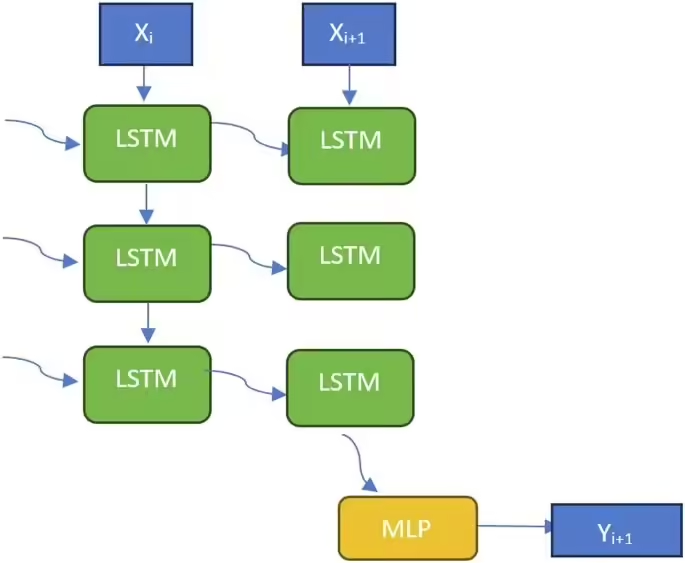

The team then developed a new model that does not directly predict specific prices, but rather predicts market trends and uses 100 days of historical data as input, extracting repetitive patterns in the historical data via CNN while allowing the model sensitivity to be adjusted according to random fluctuations in different stock markets to give the predictions more practical value. However even the improved method is not accurate in such a noisy and chaotic environment as the stock market.

Note: The above conclusions are limited to tracking 12 stocks only, tracking different stocks in different markets may result in different conclusions, the above information is for reference only.

refer to