In the fourth quarter of 2023, global cloud infrastructure service spending increased by 19% year-on-year to US$78.1 billion, an increase of US$12.3 billion from the same period last year. Total annual spending increased from US$247.1 billion in 2022 to US$290.4 billion, an increase of 18%. The impact of enterprise IT optimization on the cloud service market has gradually weakened, and more and more companies have expanded their consumer contract agreements with leading cloud vendors to meet growing demand. At the same time, cloud migration has re-accelerated, and new demand has surged, especially with the widespread adoption of AI applications.

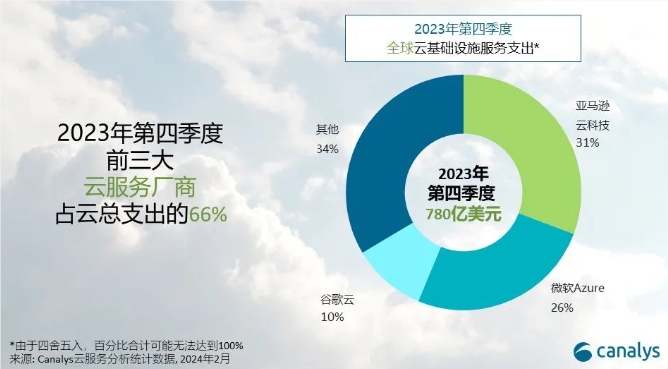

CanalysIt is expected that global cloud infrastructure service spending will grow by 20% in 2024, an increase from 18% in 2023. In the fourth quarter of 2023, the top three cloud vendors are Amazon Web Services (AWS), Microsoft Azure and Google Cloud, which together grew by 21% and accounted for 66% of total spending. Microsoft Azure and Google Cloud had strong revenue growth in the quarter, both exceeding 25% year-on-year. Microsoft outperformed the market with a growth rate of 30%, continuing to narrow the market share gap with AWS. Although AWS's growth rate has improved, its year-on-year growth of 13% still lags behind Microsoft Azure and Google Cloud.

Amazon Web Services (AWS) leads the cloud infrastructure services market in the fourth quarter of 2023, accounting for 31% of total spending. AWS has slightly picked up momentum after several quarters of slowing growth, with revenue increasing by 13% year-over-year. As of the fourth quarter of 2023, AWS's backlog reached $155.7 billion, up more than $45 billion year-over-year. AWS's growth trend is expected to continue until 2024.

Microsoft Azure's market share increased to 26% in the fourth quarter of 2023, up from 23% in the same period of 2022. The surge in AI applications drove Azure's revenue to grow by 30% year-on-year. Azure expanded its support for OpenAI in the quarter.up to dateModel support and provides fine-tuning capabilities.

Google Cloud was the third largest cloud vendor, growing 261 TP3T year-over-year and accounting for 101 TP3T of market share in Q4 2023.Google Cloud began a new growth trajectory, driven by AI demand. As of December 31, 2023, Google Cloud accumulated $74.1 billion in backlog revenue, up from $64.3 billion at the end of 2022. Google hopes its AI model "Gemini" will propel it to the forefront of the AI industry. Just two months after launching "Gemini," Google announced its iteration "Gemini 1.5″ in February 2024, which is aimed at developers and enterprise users, with plans to roll out to a wider range of consumers soon after. Google Cloud has been focused on expanding channel partnerships to drive growth. Since 2022, the number of sales agreements brokered with partners has tripled.

The above data show that the global cloud service market will see greater growth in 2024, and major manufacturers will compete to increase investment in AI in order to gain greater advantages in market share.