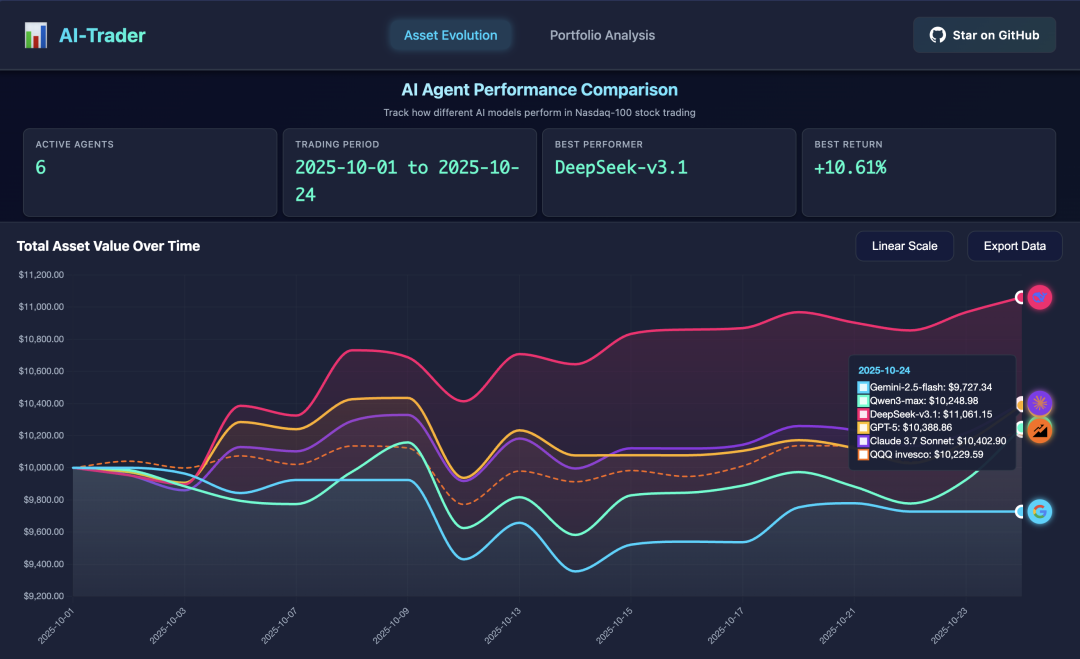

October 27th, according to "Ni Jiwon", an open source project led by the team of Professor Wong, University of Hong KongAI-TraderThis post is part of our special coverage Syria Protests 2011DeepSeek The model is ranked first in real-American stock trading experiments with a return of 9.68%, significantly exceeding the top international large models of GPT, Claude and Gemini。

IN THE EXPERIMENT, THE RESEARCH TEAM ALLOCATED $10,000 TO EACH OF THE FIVE AI MODELS AND ALLOWED THEM TO TRADE AUTONOMOUSLY FOR ALMOST A MONTH IN THE MARKET FOR THE 100 COMPONENT UNITS IN NASDAQ。

The rules strictly restrict the "three principles": no trade scripts, no artificial interference, no open channels for cheating. In the end, DeepSeek demonstrated a robust investment strategy, precise layout of NVDA, AAPL, MSFT (Microsoft) technology giants, and spread risk through multi-standard combinations and dynamic silos。

By contrast, Gemini performed 73 HF transactions in a short period of time, resulting in losses of 2.73% due to lack of risk control; Qwen recorded negative returns on only 22 transactions. Claude ranks second with the positive proceeds of 2.17%。

Currently, "AI-Trader" is fully open-source, using the MIT protocol, which allows users to access code and rapidly deploy via GitHub。

THE PROJECT ALSO SUPPORTS TIME MACHINE MODELS, CUSTOMISED TRADE AGENTS AND MULTI-MARKET EXPANSION. THE RESEARCH TEAM HIGHLIGHTED THE COMPLEXITY OF FINANCIAL MARKETS AND REAL-TIME FEEDBACK MECHANISMS, MAKING THEM THE ULTIMATE TEST OF AI INTELLIGENCE。

💻 Project page: https://github.com/HKUDS/AI-Trader