On November 27, according to Fortune magazine Local Time, November 26, one of the major concerns of the current capital market is OpenAI How to make real money in your business model while meeting the almost unlimited computing needs of ChatGPT。

HSBC BankOn the one hand, I insist AI It's a long-term growth line, and it's assumed that OpenAI will remain in the lead in income; on the other hand, calculations suggest that if OpenAI wants to meet its objectives, the next decade willI'm under extreme financial pressure.

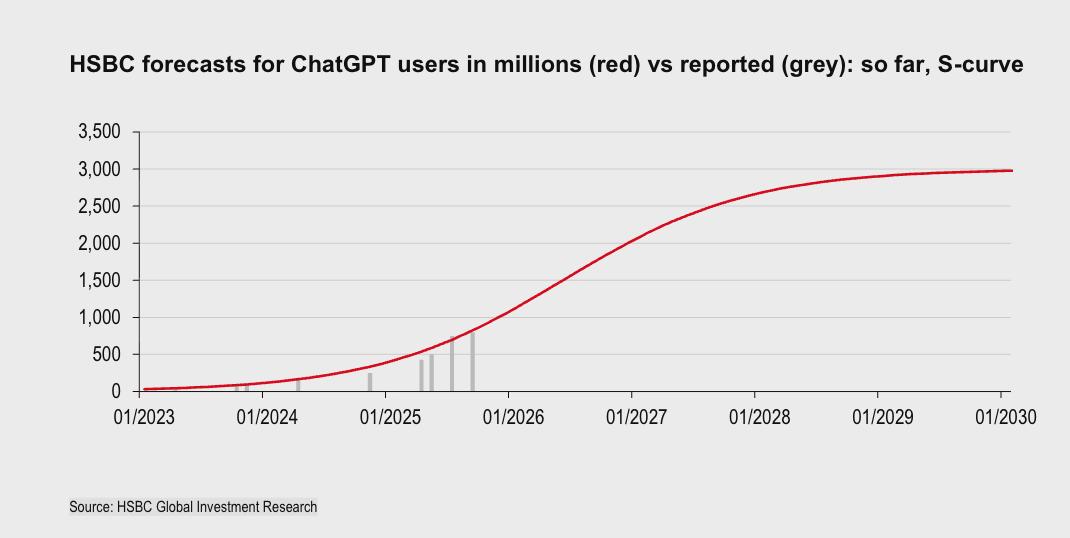

HSBC expects that by 2030, OpenAI will cover 44% of adults worldwideBut it's not profitableI DON'T KNOW. IN ADDITION, IN ORDER TO SUSTAIN GROWTH PLANS, COMPANIES NEED AT LEAST $207 BILLION IN ADDITIONAL ENERGY INPUTS (NOTE: THE CURRENT EXCHANGE RATE IS ABOUT RMB 1.47 TRILLION). HIGH INFRASTRUCTURE COSTS, INCREASED COMPETITION AND AN UNPRECEDENTED LEVEL OF CAPITAL-INTENSIVE AI MARKETS TOGETHER FORM THE BACKGROUND FOR THIS JUDGEMENT。

In updating the model, the HSBC team included all of OpenAI and Microsoft $250 billion and the $38 billion long-term cloud agreement with Amazon, noting that these expansion commitments were not accompanied by new financing. OpenAI aims to reach 36 GW calculus by the end of the year, which is the size of a near-medium state。

HSBC projections, OpenAI to 2030Free cash is still negativeThe overall shortfall will be $20.7 billion. Even though the company may have broken $213 billion in 2030Still insufficient to cover the computing and data centre lease costsI don't know. In the end, additional funding will be required to increase the proportion of subscriptions paid, to enter more advertising markets and to improve the efficiency of the economy。

OpenAI’s outlook closely binds its investors to the AI industrial chain. Microsoft and Amazon are both partners and investors, and Oracle, Weibo and AMD are also affected by their ups and downs. However, the risks are equally clear: the sustainability of business models, saturation in subscription markets, increased regulation and excessive capital demand are not conclusive。

HSBC notes that companies may continue to borrow, but that current market conditions are extremely difficult. Oracle and Meta recently raised a large amount of debt for AI capital expenditure, raising concerns about the sustainability of AI financing, and the apparent increase in the credit default swap for Oracle has prompted analysts to warn。

On a more macro level, HSBC quotes Solo -- "You can see the traces of the computer age anywhere, but you can't see them in productivity statistics," and reminds of productivity growthNot as prominent as the technological revolutionI don't know. Doubts have also been expressed as to whether the 30-year return on the Internet revolution has actually materialized. Federal Reserve Chairman John Williams has pointed out that the productivity gains of new technologies are more in leisure consumption than in office and manufacturing。