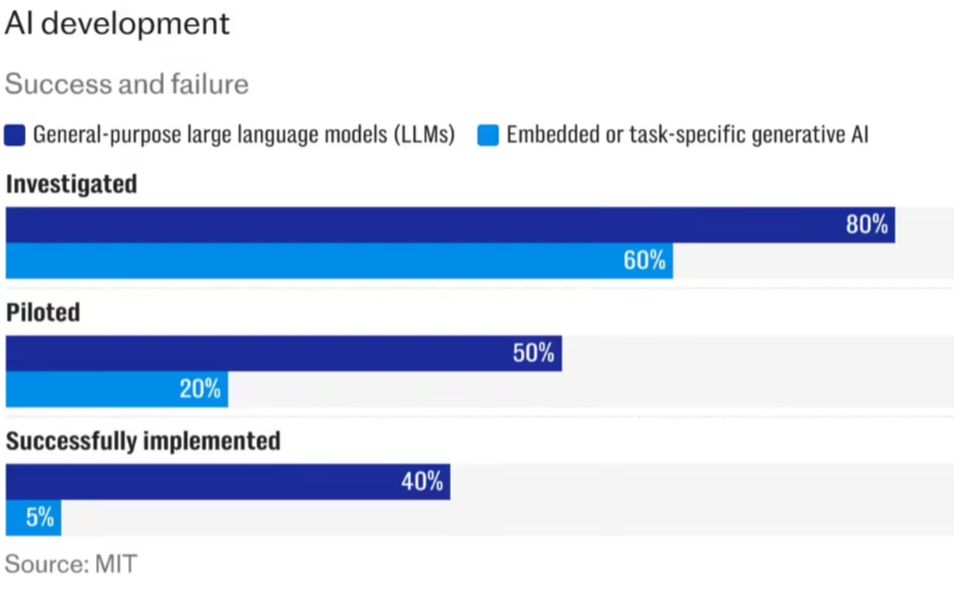

August 23rd.Massachusetts Institute of Technology(MIT) new report warns that 95%'s generative AIinvestwhich has generated little or no revenue for the business.Half of the projects ended in failure, with only 5% landing in commercialization.

Telegraph Media believes the market is affected by this concern AI The bubble is on the verge of bursting, causing NVIDIA shares to fall 3.5%, Palantir to fall 9%, and SoftBank to fall 7%.

1AI cites the report that despite companies investing as much as $30 billion to $40 billion in the field (note: current exchange rates are approximately RMB 215.183 billion to RMB 286.911 billion), 95% of projects have failed to generate any financial returns, half of AI projects have ended in failure, only 40% of companies have put AI applications into actual deployment, and only 5% of Only 40% of companies deployed AI applications in the field, and only 5% of pilots ended up in production. This finding has caused the market to worry that the AI boom may repeat the mistakes of the 2000 dot-com bubble.

As a result of this report, U.S. tech stocks plummeted on Tuesday. shares of AI chip leader Nvidia fell 3.5%, data analytics company Palantir plummeted 9%, and Japan's SoftBank fell 7% due to its heavy exposure to AI projects.

MIT notes that many organizations are "quietly abandoning" complex and expensive enterprise AI systems, with employees preferring to pay for consumer-grade tools such as ChatGPT.

The report comes at a time when market confidence in the profitability of AI is waning. Since the launch of ChatGPT in 2022, Silicon Valley has been claiming that AI will bring huge savings and efficiency gains, but the reality has fallen short of expectations.

OpenAI's release of ChatGPT-5 was also seen as a limited upgrade, with many users calling for a return to the old version, and OpenAI CEO Sam Altman admitting that investors "did get a little over-excited" and that there could be heavy losses ahead.